In the tapestry of life, uncertainty weaves its way through every thread. While we cannot control all unforeseen circumstances, securing our loved ones’ future against financial hardship is a responsibility we wholeheartedly embrace. This is where insurance companies like INGWE Life step in, offering a comforting hand and robust policies to navigate life’s unpredictable paths.

This comprehensive guide delves into the realm of INGWE Life insurance, unpacking its offerings, exploring its diverse range of products, and equipping you with the knowledge to make informed decisions about your insurance needs.

Understanding INGWE Life: A Legacy of Service

Established in 1999, INGWE Life has carved a niche in the South African insurance landscape, catering primarily to the lower to middle-income market. Driven by a client-centric ethos and a commitment to affordable insurance solutions, the company has grown a loyal customer base, exceeding 1 million policyholders strong.

INGWE Life distinguishes itself through several key pillars:

- Accessibility: Focused on making insurance accessible to all, INGWE Life offers affordable premiums and flexible payment options, ensuring financial protection transcends socio-economic boundaries.

- Community Focus: Understanding the unique needs of its target market, INGWE Life tailors its products and services to resonate with the cultural and social realities of its clientele.

- Personalization: Believing in the power of individual attention, INGWE Life encourages direct communication with clients, prioritizing personalized service and building trust.

- Innovation: Embracing technological advancements, INGWE Life leverages digital platforms to streamline processes, enhance customer experience, and promote efficient service delivery.

Navigating the Insurance Maze: Demystifying Products and Solutions

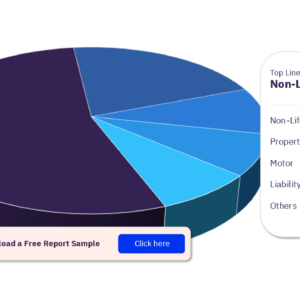

INGWE Life offers a diverse portfolio of insurance products, catering to a spectrum of needs:

- Funeral Cover: This cornerstone product provides financial assistance for funeral expenses, alleviating financial stress during a time of grief. Options range from individual cover to comprehensive family plans, ensuring every family member is protected.

- Life Cover: Offering financial security in the event of death, life cover provides a lump sum payout to your beneficiaries, safeguarding their future and ensuring their well-being in your absence.

- Educational Cover: Investing in your children’s education is paramount. Educational cover plans secure their educational expenses, ensuring their academic aspirations are not hindered by financial limitations.

- Savings and Investment Products: Combining insurance with long-term financial goals, INGWE Life offers endowment plans and savings products that grow your wealth over time while providing life cover, granting both protection and financial growth.

Making the Right Choice: Factors to Consider

Selecting the right insurance solution requires careful consideration of several factors:

- Needs Assessment: Identify your family’s needs and potential financial vulnerabilities. Consider income, existing debts, dependents, and future aspirations.

- Budgeting: Determine your comfortable premium payment range and prioritize affordability without compromising adequate coverage.

- Policy Comparison: Research and compare offerings from various insurance providers, analyzing coverage details, exclusions, and benefits.

- Understanding Policy Exclusions: Carefully review excluded circumstances under each policy to ensure your coverage aligns with your specific needs.

- Seeking Professional Advice: Consulting a qualified insurance advisor can be invaluable, providing personalized guidance and navigating the complexities of choosing the right plan.

Beyond the Policy: Embracing Peace of Mind

By partnering with INGWE Life, you gain more than just insurance coverage. You receive a commitment to service, a personalized approach to understanding your needs, and a community of support dedicated to empowering your financial security. With INGWE Life, you can navigate life’s uncertainties with confidence, knowing your loved ones are protected and your future is secured.

Remember: Choosing the right insurance is an investment in your future and the well-being of your loved ones. By understanding your needs, researching options, and embracing INGWE Life’s client-centric approach, you can secure peace of mind and pave the way for a brighter tomorrow.

Additional Resources:

- INGWE Life website: https://www.ingwelife.com/

- INGWE Life contact information: https://www.ingwelife.com/contact-us/

- South African Insurance Association: https://www.saia.co.za/

By actively engaging with your insurance needs and partnering with a reputable provider like INGWE Life, you can weave a safety net of protection against life’s unpredictable turns, ensuring your loved ones face the future with a sense of security and unwavering care.