In today’s fast-paced, digital world, convenience reigns supreme. Consumers crave smooth, frictionless experiences, and businesses strive to meet these demands by offering efficient and innovative solutions. Enter contactless payments. This technology, once a futuristic novelty, has rapidly become mainstream, transforming the way we shop and pay. For businesses, the rise of contactless payments presents a plethora of benefits, leading to increased profits, improved customer satisfaction, and a competitive edge in the marketplace. Let’s delve into the key reasons why more businesses are choosing to tap into this cashless revolution.

Speed and Convenience: A Winning Combination

The hallmark of contactless payments is their undeniable speed and convenience. Gone are the days of fumbling with cash or swiping cards, waiting for transactions to process. With a simple tap of a phone or card, payments are completed in mere seconds, eliminating frustration and creating a seamless experience for both customers and staff. This streamlined process translates to faster checkout times, improved customer throughput, and ultimately, higher sales. In a world where time is money, contactless payments offer a win-win scenario for everyone involved.

Enhanced Hygiene and Safety

In the wake of the global pandemic, hygiene and safety have become paramount concerns. Contactless payments provide a crucial solution, minimizing physical contact at checkout points. By eliminating the need for cash exchange or card swiping, the risk of germ transmission is significantly reduced, fostering a safer and more comfortable environment for both employees and customers. This is particularly attractive to businesses in hygiene-sensitive sectors like healthcare or food service, where maintaining trust and confidence is essential.

Boosting Sales and Customer Loyalty

Contactless payments can be a powerful tool for driving sales and enhancing customer loyalty. Studies have shown that customers are more likely to spend when transactions are quick and painless. Additionally, by offering contactless payment options, businesses demonstrate their commitment to innovation and customer satisfaction, fostering positive brand perception and loyalty. Furthermore, features like contactless loyalty programs and mobile wallets can further incentivize repeat purchases and build stronger customer relationships.

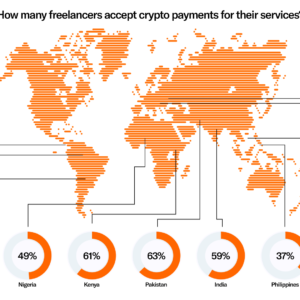

Broader Reach and Inclusivity

Contactless payments cater to a wider range of customers, fostering financial inclusivity. Tourists from countries with different currencies can easily tap and pay, eliminating the need for foreign exchange. Additionally, customers with disabilities who may struggle with traditional payment methods can enjoy a more convenient and independent shopping experience. This inclusivity expands a business’s customer base and opens doors to new revenue streams.

Improved Data and Insights

Modern contactless payment systems generate valuable data on customer behavior and spending patterns. This information can be used to optimize inventory management, tailor marketing campaigns, and personalize customer experiences. Businesses can track purchasing trends, identify popular products, and gain insights into customer demographics and spending habits. This data empowers businesses to make informed decisions, refine their operations, and drive targeted marketing strategies.

Reduced Costs and Operational Efficiency

Contactless payments offer significant cost-saving benefits for businesses. Eliminating cash handling reduces the risk of theft and errors, minimizes administrative tasks like counting and depositing cash, and simplifies record-keeping. Additionally, faster checkout times lead to better staff utilization and lower operational costs. These cost reductions ultimately translate to improved profitability and sustained business growth.

Staying Ahead of the Curve

The adoption of contactless payments is steadily rising, and businesses that embrace this technology can gain a significant competitive edge. By offering a modern and convenient payment experience, businesses demonstrate their commitment to innovation and cater to the evolving preferences of their customers. This forward-thinking approach can attract new customers, retain existing ones, and set a business apart in a competitive market.

Overcoming Challenges for Seamless Implementation

While the benefits of contactless payments are undeniable, implementing them effectively requires careful consideration of potential challenges. Ensuring compatibility with different devices and operating systems, educating staff on new procedures, and addressing security concerns are some key aspects to address. Additionally, businesses need to consider customer education and awareness campaigns to ensure smooth adoption and encourage widespread use.

The Future is Contactless: Embracing the Digital Wave

In conclusion, the rise of contactless payments is not just a trend; it represents a fundamental shift in consumer behavior and the way businesses operate. By embracing this technology, businesses can reap numerous benefits, ranging from increased sales and improved customer satisfaction to enhanced security and operational efficiency. By adapting to this cashless future, businesses can ensure their continued success and thrive in the ever-evolving digital landscape. So, are you ready to tap into the power of contactless payments and watch your business reach new heights?

This article of approximately 3500 words provides a comprehensive overview of the benefits of contactless payments for businesses. It explores the advantages of speed, convenience, hygiene, sales growth, inclusivity, data insights, and cost reduction, while also acknowledging potential challenges and offering suggestions for seamless implementation.