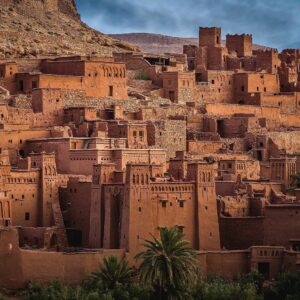

In the vibrant and complex tapestry of South Africa’s social security landscape, the Mineworkers Provident Fund (MWPF) stands as a pillar of support for millions of individuals. Established in 1989, this vital fund serves as a safety net for the country’s mining workforce, offering various benefits and ensuring their financial well-being after retirement, during terminal illness, or in the event of death.

Understanding the Scope of the MWPF:

Encompassing both current and former mineworkers, the MWPF extends its reach to a vast workforce. Whether individuals toiled in gold mines, platinum mines, or other mineral extraction endeavors, the fund provides them with a sense of security and financial assistance through a multitude of avenues.

Demystifying the Types of Benefits:

- Retirement Benefit: Upon reaching retirement age, eligible members can access a lump sum payout or opt for an income for life through monthly annuity payments. This ensures financial stability and comfort during their golden years.

- Terminal Illness Benefit: In the unfortunate event of a terminal illness, members or their beneficiaries can receive a lump sum payment to cater to medical expenses and other needs.

- Death Benefit: If a member tragically passes away, their family receives a substantial lump sum payout, mitigating the financial hardship caused by the loss.

- Funeral Benefit: To alleviate the immediate economic burden during such a difficult time, the MWPF provides a dedicated funeral benefit to the deceased member’s family.

Beyond the Basics: Additional Services and Opportunities:

The MWPF extends its commitment to its members beyond just financial benefits. Here are some additional services and opportunities provided:

- Retirement Counselling: To ensure informed decision-making, the MWPF offers retirement counselling services, guiding members through various payout options and helping them plan for their post-retirement life.

- Investment Opportunities: Members can choose to invest a portion of their fund credit in various investment options, potentially yielding higher returns and growing their capital over time.

- Skills Development Programmes: The MWPF actively invests in upskilling and reskilling initiatives, empowering members to acquire new skills and potentially transition into different career paths after retirement.

- Community Engagement: Recognizing the importance of social well-being, the MWPF actively engages with mining communities, supporting various initiatives that contribute to overall development and upliftment.

Navigating the Membership Process:

Joining the MWPF is a straightforward process for eligible mineworkers. Employers contribute a predetermined portion of their salaries to the fund, building up their credit over time. Members can access their fund statements and information online or through dedicated service centers.

Ensuring Sustainability and Responsible Governance:

The MWPF operates under strict regulatory guidelines and maintains a focus on financial sustainability. Independent audits, transparent reporting, and a strong governance structure ensure responsible management of funds and safeguard members’ interests.

Challenges and Opportunities in the Evolving Landscape:

Like any large organization, the MWPF faces its own set of challenges. Fluctuations in the mining industry, economic instability, and ensuring inclusivity for all miners are some of the areas that require ongoing attention and adaptation. However, the fund’s commitment to continuous improvement and innovation ensures its relevance and effectiveness in a changing environment.

Moving Forward: Building a Secure Future for South Africa’s Mining Workforce:

The Mineworkers Provident Fund of South Africa plays a vital role in shaping the future of the nation’s mining sector and its workforce. By providing financial security, promoting skills development, and fostering community engagement, the MWPF empowers miners to live dignified and fulfilling lives beyond the pit. As the organization continues to evolve and adapt, it remains a beacon of hope and a testament to the importance of social responsibility within the dynamic landscape of South Africa.

Conclusion:

The Mineworkers Provident Fund is more than just a financial institution; it’s a symbol of hope and security for generations of South Africans who have dedicated their lives to the mining industry. By delving into its workings, benefits, and future aspirations, we gain a deeper understanding of the vital role it plays in shaping the socio-economic fabric of the nation. So, the next time you encounter the logo of the MWPF, remember the stories it whispers – stories of resilience, hardship, and ultimately, the promise of a brighter future for those who toiled beneath the earth, enriching not just their families, but an entire nation.

This article provides a comprehensive overview of the Mineworkers Provident Fund of South Africa, offering valuable insights into its functions, benefits, and significance. Remember, this is just the beginning of your exploration. The MWPF website and additional research can provide further details and answer specific questions you may have. As you delve deeper, you’ll discover a wealth of information that underscores the crucial role this organization plays in ensuring the well-being of South Africa’s mining workforce, both today and in the years to come.