In today’s interconnected world, freelance opportunities transcend geographical boundaries. Skilled individuals can offer their services to clients across the globe, opening doors to diverse projects and a wider professional reach. But with this exciting freedom comes the challenge of receiving payments securely and efficiently, especially when navigating different currencies and international regulations. Thankfully, the rise of cryptocurrencies offers a revolutionary solution: crypto invoices.

Why Crypto Invoices are a Game-Changer for Freelancers:

Traditional payment methods for freelancers often pose limitations and drawbacks:

- International fees: Bank transfers and credit card transactions can incur hefty fees, especially for cross-border payments.

- Currency conversions: Fluctuating exchange rates can eat into your earnings when dealing with clients in different currencies.

- Payment delays: Waiting times for traditional payments can be unpredictable, impacting your cash flow and financial stability.

- Limited access: Freelancers in certain regions may face restrictions on international transactions due to financial regulations or banking infrastructure limitations.

Crypto invoices overcome these hurdles by utilizing the unique properties of decentralized digital currencies:

- Borderless transactions: Send and receive payments instantly and securely anywhere in the world, regardless of geographical location or banking infrastructure.

- Reduced fees: Transaction fees associated with cryptocurrencies are generally much lower than traditional international transfers.

- Direct transfers: Crypto allows for peer-to-peer transactions, eliminating intermediaries and minimizing the risk of delays or disruptions.

- Currency flexibility: Choose the cryptocurrency that best suits your needs and avoid unnecessary conversions that incur exchange rate risks.

Setting Up Your Crypto Invoice Workflow:

Embracing crypto invoices as a freelancer requires navigating a new landscape, but the process is surprisingly straightforward:

1. Choose your preferred cryptocurrency: Research different cryptocurrencies and select one that aligns with your comfort level, security requirements, and transaction fees. Bitcoin and Ethereum are popular choices, but explore alternatives like stablecoins for added price stability.

2. Select a crypto wallet: Sign up for a secure crypto wallet that allows you to send and receive the chosen cryptocurrency. Popular options include Coinbase Wallet, MetaMask, and Ledger Nano S. Ensure your wallet has functionality for generating invoices and receiving payments.

3. Choose an invoicing platform: Several platforms facilitate crypto invoice creation and payment processing. Popular options include InvoiceNinja, Coinpayments, and Bitpay. Select a platform that seamlessly integrates with your chosen cryptocurrency and wallet.

4. Craft your crypto invoice: Design a professional invoice template that clearly details your services, fees, and payment instructions. Include your crypto wallet address prominently and specify the chosen cryptocurrency.

5. Share your invoice and get paid: Share your crypto invoice electronically with your client via email or online platforms. Once your client sends the payment, the funds will be deposited directly into your crypto wallet.

Navigating the Crypto Landscape:

While crypto invoices offer clear advantages, it’s essential to be aware of the evolving landscape:

- Volatility: Cryptocurrency prices can fluctuate significantly. Consider hedging against price volatility if you need predictable income.

- Security: Protecting your private keys and practicing good digital hygiene is crucial to prevent theft or loss of funds.

- Tax implications: Cryptocurrency taxation varies by region. Consult a tax professional to understand your reporting obligations.

Beyond Payments: Embracing the Potential of Crypto

Crypto invoices open doors beyond simply receiving payments. Here are some additional possibilities:

- Micropayments: Enable smaller, more frequent payments for ongoing projects or micro-transactions.

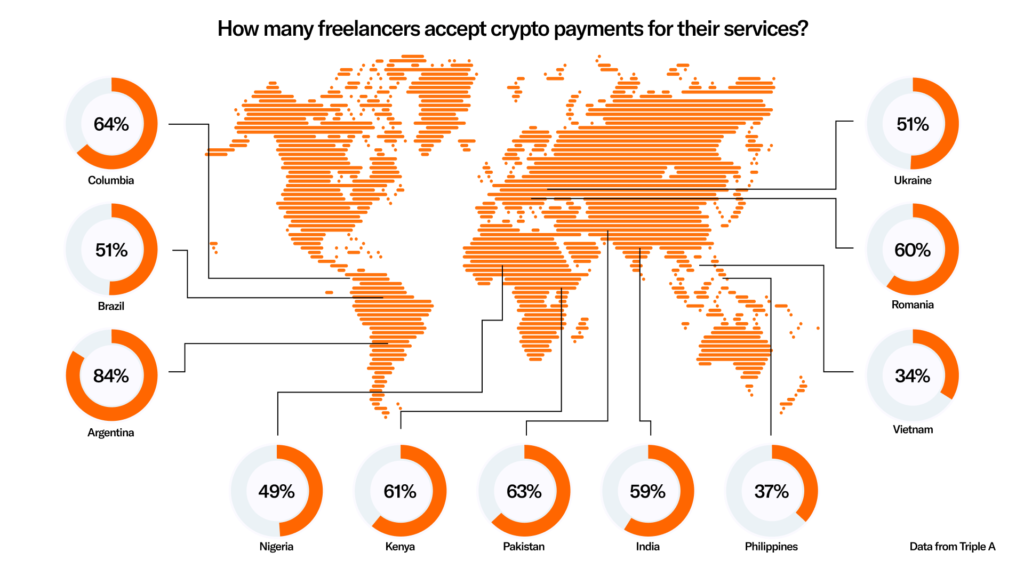

- Global talent pool: Facilitate collaboration with international clients and partners without geographical constraints.

- Subscriptions and recurring payments: Set up recurring crypto payments for subscription services or ongoing projects.

A Final Note: Unleashing the Power of Crypto for Freelancers

The future of freelancing is increasingly global and decentralized. Embracing crypto invoices empowers you to break free from traditional payment limitations and tap into a world of borderless, secure, and efficient financial transactions. As you navigate this exciting landscape, remember to prioritize security, stay informed about evolving regulations, and explore the possibilities beyond mere payments. With a proactive approach and a willingness to embrace change, you can unlock the full potential of crypto and thrive as a global freelancer in the digital age.