In the turbulent waters of risk management, finding a reliable anchor becomes crucial. For many Nigerian businesses and individuals, Anchor Insurance Company Ltd. has served as that very anchor, navigating them through unforeseen storms and securing their financial well-being. But who is Anchor Insurance, and what depths of insurance services do they offer? Let’s embark on a voyage of discovery, diving into the company’s history, portfolio, and unique strengths.

A Voyage Through Time: The Anchor Story

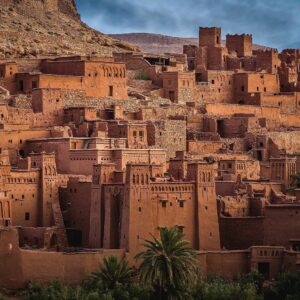

Anchor Insurance Co. Ltd. began its journey in 2005, setting sail amidst a competitive sea of insurance providers. Born from the vision of experienced maritime specialists, the company quickly found its footing by specializing in robust marine insurance solutions. Anchored by a dedicated team of professionals and a commitment to exceptional client service, Anchor soon expanded its territory, venturing into diverse insurance realms. Today, its offerings encompass a vast ocean of coverage, spanning the shores of various industries and individual needs.

Delving into the Depths: Unveiling Anchor’s Diverse Portfolio

Like a treasure map revealing hidden coves, Anchor’s portfolio unveils a wealth of insurance options. Let’s explore some of their key offerings:

- Marine Insurance: Anchoring their legacy, Anchor provides comprehensive marine insurance solutions for vessels, cargo, and offshore operations. They cater to the unique needs of the maritime industry, offering protection against a spectrum of risks, from collisions and cargo damage to hijacking and pollution events.

- General Insurance: Beyond the waves, Anchor delves into terrestrial horizons, offering a plethora of general insurance solutions. From fire and property insurance to motor vehicle and liability coverage, they provide a safety net for businesses and individuals, mitigating risks across various aspects of life.

- Business Insurance: Recognizing the challenges faced by businesses, Anchor offers tailored insurance packages to mitigate operational risks and financial losses. Whether it’s liability coverage for manufacturers or business interruption insurance for retailers, they provide peace of mind for entrepreneurs navigating the commercial waters.

- Life Insurance: Life’s journey can be unpredictable, but Anchor helps provide a sense of security for loved ones. Their life insurance products offer financial protection in the event of death, ensuring families can weather life’s storms.

- Health Insurance: Health concerns can create unforeseen waves, but Anchor offers various health insurance plans to navigate these choppy waters. Their coverage options protect individuals and families against medical expenses, ensuring access to quality healthcare when needed.

Surfacing Strengths: What Makes Anchor Stand Out?

In a vast ocean of insurance providers, what makes Anchor distinct? Here are some factors that set them apart:

- Claim Settlement Efficiency: Recognizing the importance of prompt assistance, Anchor prides itself on its efficient claim settlement process. They strive to minimize delays and provide fair compensation to their clients in times of need.

- Risk Management Expertise: Anchor’s team boasts extensive experience in identifying and mitigating risks. They offer not just insurance coverage but also valuable risk management advice, helping clients proactively navigate potential dangers.

- Technology Integration: Embracing the digital wave, Anchor leverages technology to enhance their services. Their online platform allows for easy policy management, claim filing, and access to vital information, increasing transparency and convenience for clients.

- Customer-Centric Approach: At the heart of Anchor’s mission lies a commitment to customer satisfaction. They prioritize building strong relationships with their clients, ensuring personalized attention and responsive support throughout the insurance journey.

- Financial Stability: Anchored by strong financial backing, Anchor provides clients with the assurance of a company capable of weathering financial storms and fulfilling its obligations. This stability breeds trust and confidence in their ability to provide long-term protection.

Charting Your Course: Choosing the Right Anchor

With a diverse portfolio and unique strengths, Anchor Insurance positions itself as a reliable partner for individuals and businesses seeking to navigate the uncertain waters of risk. However, choosing the right insurance provider requires careful consideration. Here are some tips to guide your navigation:

- Assess Your Needs: Identify your specific risks and coverage requirements. Are you a business owner seeking liability protection, or an individual looking for health insurance? Understanding your needs helps you choose the right type of insurance from Anchor’s portfolio.

- Compare Policy Options: Don’t settle for the first anchor you encounter. Compare coverage details, premiums, and claim settlement processes offered by different Anchor plans and even by competing insurance providers.

- Consider Customer Reviews: Seek feedback from existing Anchor clients to understand their experiences with the company’s service, claim settlement efficiency, and overall customer support.

- Seek Professional Advice: Consulting with an insurance broker or financial advisor can provide valuable insights and personalized recommendations based on your specific needs and budget.